ct sports betting tax

It will likely help to bring Connecticut a huge amount of. That isnt the complete list of all gambling winnings that are taxable though.

New York Gives Go Ahead For Sports Betting From Phones Expects 500m In Tax Revenue

And the Mohegan Tribe of Indians of Connecticut on May 17 1994 as amended from time to time.

. Sports betting losses are tax-deductible but under very specific conditions. 24 Tax Withheld. Some of the OTB locations include.

12000 and the winner is filing separately. At the statutory rate of 1375 reaching that number would require operators to generate around 180 million in combined revenue annually. 13000 and the winner is filing single.

Connecticut will get its cut of online casino gambling and sports betting. In fact every dollar you win gambling is taxable. Each company will pay an 18 percent tax for online gaming revenues during the.

Osten co-chair of the Appropriations Committee told CT Examiner that legislators expect about 80 million in. A 1375 tax rate on sports wagering and an. 24000 and the winner is filing.

The total amount owed for taxes on gambling winnings depends on the total amount earned by. Connecticut raked in more than 4 million in revenue from its nascent online gambling and sports wagering industry in November the first full month of legalized betting. Many are still hopeful that Connecticuts first sports betting options will launch prior to the start of the 20212022 NFL season.

12625 and the winners filing status for Connecticut income tax purposes is Single. The good news is that off-track betting is allowed in the state where people can place their wager on horse racing. Even when you gain less than the above-stated amount your legal obligation is to disclose these proceeds as income on your federal liabilities.

An IRS Form W2-G is being used for reporting the winnings from gambling. The companies will pay an 18 percent tax on online gaming revenues for the first five years of operation and then 20 percent in the years after. That led to more than 1 million total taxes paid for the month.

You can quickly determine what you should report on your tax return when you receive a W2-G. The lifting of this prohibition has also provided legal. Connecticuts tax coffers gained about 25 million from online casino gaming and 17 million from sports betting last month on a total of 4446 million in wagers.

The state will collect taxes of 18 initially on online. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds. 20 Off-track betting system licensee means the person or business.

The IRS code includes cumulative winnings from. The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026. 19000 and the winner is filing head of household.

Connecticut adopted emergency regulations Tuesday intended to. Malloy first talked up sports betting in 2018 when the US. So if you lost 5000 on sports betting last year but took home 7000 in the end youd be able to deduct all of those losses.

Pari-mutuel wagering is available on various off-track betting locations in Connecticut State. Most states allow offshore sports gambling but until recently Connecticut had a prohibition in place for all online gaming. Connecticut sports betting revenue is taxed at 1375.

April 18 2022 Connecticuts three mobile sportsbooks combined for 1319 million in handle and 67 million in revenue during March. The retail sportsbooks through the Connecticut Lottery added 88 million in handle and 827609 in revenue. The standard amount withheld by sportsbooks to cover sports betting taxes on wins is 24.

19 Occupational employee means an employee of a master wagering licensee or a licensed online gaming operator online gaming service provider or sports wagering retailer. 19000 and the. This season is expected to be the most-wagered-on one in history.

The sports betting tax rate for CT is 1375 Connecticut lottery can take up to 15 retail sportsbooks Bettors cannot place wagers on Connecticut college sports teams. The final vote on HB 6451 was 122 to 21 with eight people. The PlaySugarHouse Sportsbook service is operated by Rush Street Interactive CT RSI CT an affiliate of a US-based casino group Rush Street Gaming that owns and operates several leading land-based casinos in the US including the Des Plaines-located Rivers CasinoThe RSG group has been developing land-based casinos in North America since 1996 and fully understands the.

Supreme Court struck down a. Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24. This is a flat rate meaning that it applies to everyone winning money regardless of how much money they win and how much their annual income is.

Thats the expected amount that will be owed when it comes tax time each year but that doesnt mean its the amount that is actually owed. 12000 and the winners filing status for Connecticut income tax purposes is Married Filing Separately. The CT House of Representatives passed legislation regarding sports betting and online gaming in the state Thursday.

If you lost 15000 on sports. The most important of these conditions is that you cant claim losses that total more than your gains. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds.

The Illinois sports betting tax rate is 495. The state to operate an online sports betting skin through the Connecticut State Lottery. The companies will also pay a 1375 percent tax on sports and fantasy sports betting.

How much revenue will CT sports betting generate. Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. That changed in 2021 when the CT state legislature passed a bill allowing for legal Connecticut sports betting across all fronts - in-person online and mobile.

The tribes state lawmakers and then-Gov.

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com

Five Things To Know About Legalized Sports Betting In Connecticut

Ct Gaming Interactive And Salsa Technology In Content Exchange Deal Interactive Technology Salsa

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

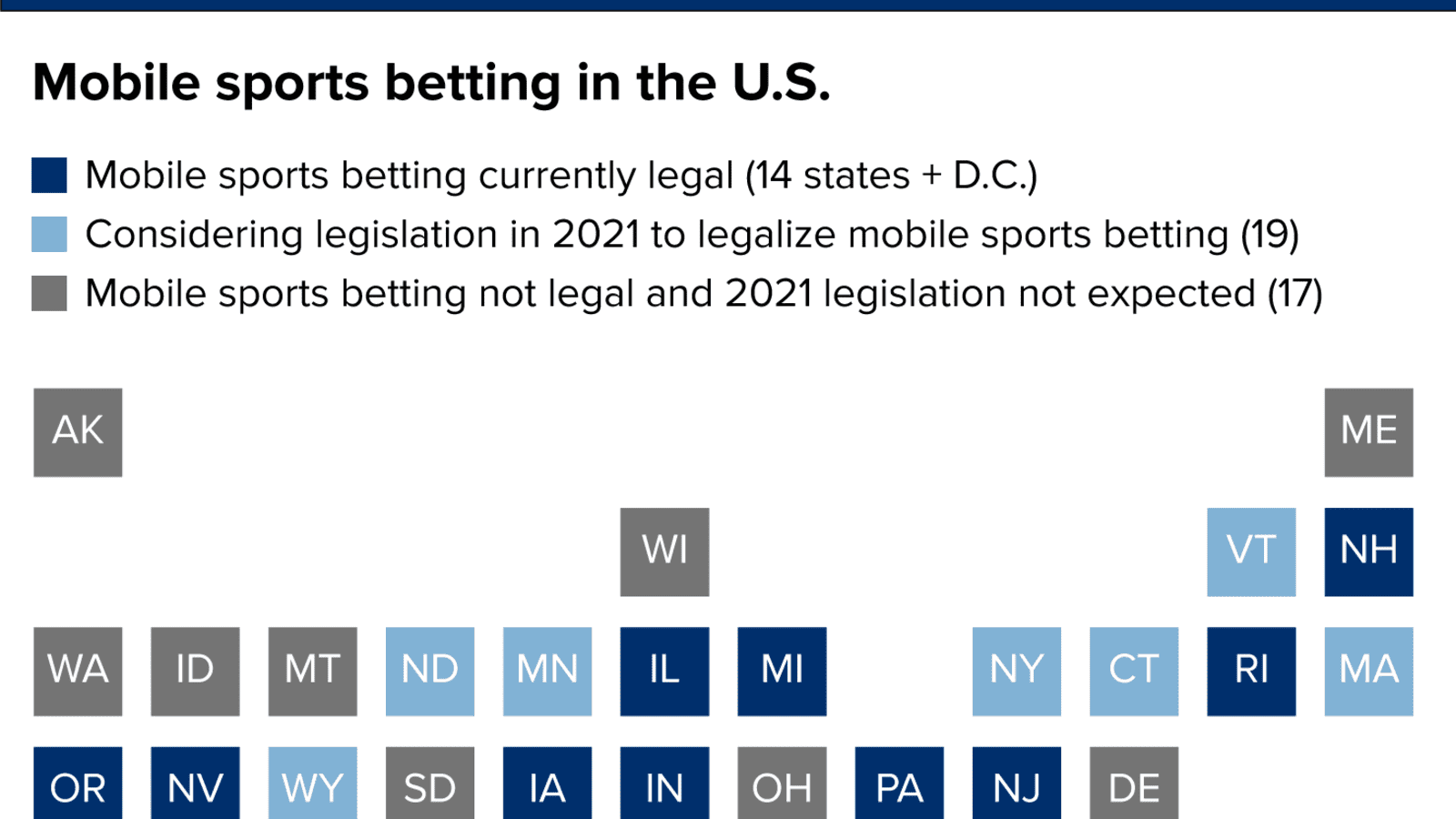

Is Sports Betting Legal In My State

Opinion Sports Gambling Is Another Tax On The Poor And Minorities

Sports Betting Vs Netflix Which Costs You Less

Tennessee Online Sports Betting Which Mobile Sportsbook App Is Best

Gambling Pays Out A 38 Billion Bonus To Tax Collectors Winning Lottery Numbers Lottery Numbers Lotto Numbers

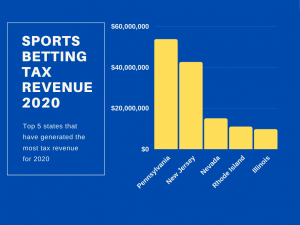

Sports Betting Tax Revenue By State Top 5 Earners Odds Com

Sports Betting In Mass Gains Momentum But College Sports Credit Card Bets Remain Friction Points Masslive Com

Is Sports Betting Legal In My State

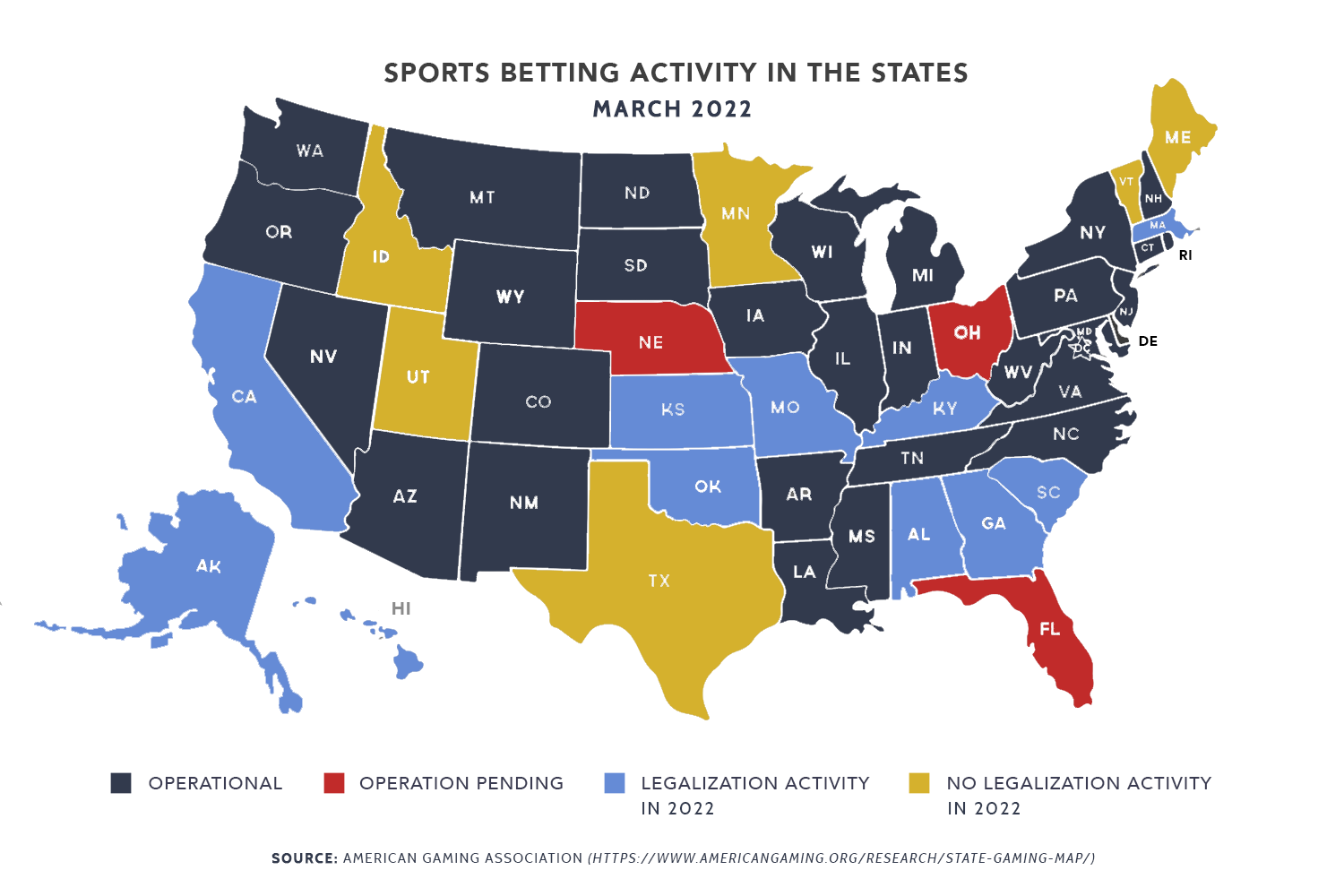

Assessing State Sports Betting Structures Aaf

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut

Show Me The Money Sports Betting Off And Running The Pew Charitable Trusts Sports Betting Show Me The Money Betting